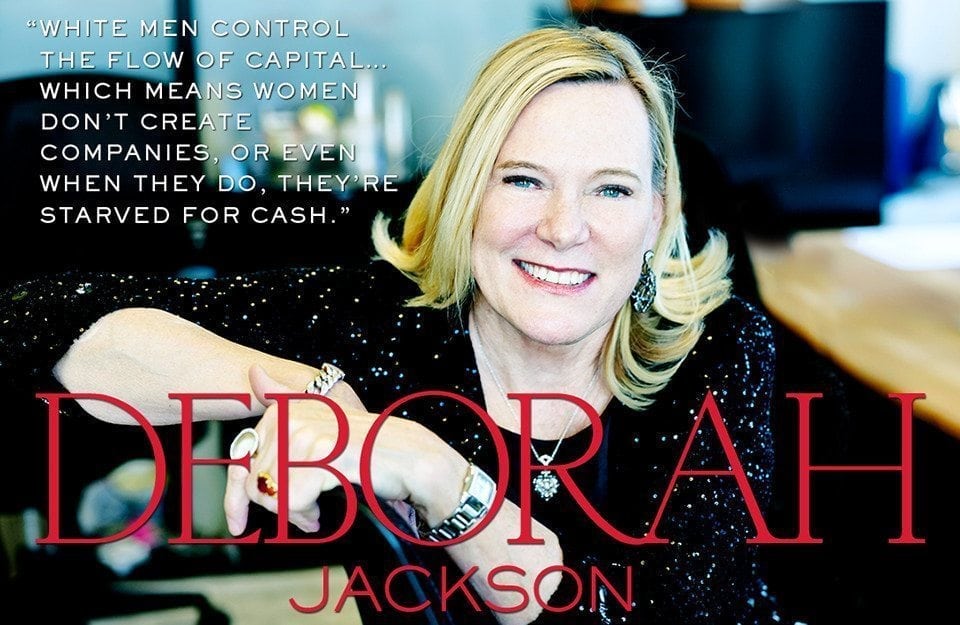

Crowdfunding platforms use the power of the internet and social media to raise small amounts of money from lots of people. While crowdfunding’s nothing new, Plum Alley is the first to focus on women entrepreneurs. With a background in finance from Columbia Business School, and over 21 years as an investment banker on Wall Street, Deborah Jackson, Plum Alley Founder and CEO knows all too well the investment community is a male-dominated business.

“WOMEN NEED TO STEP UP. WOMEN NEED TO INVEST. IT’S THE BEST OPPORTUNITY THEY HAVE TO MAKE A RETURN WHILE FURTHERING THEIR VALUES.”

“White men control the flow of capital,” said Deborah. “That’s part of the problem. I’ve been in plenty of those meetings. On one side you have a fabulous woman, pitching a great idea. Great company, big company, big business! On the other side, you have a bunch of guys who say, ’It’s not my interest.’”

At Goldman Sachs; raising money on Hillary Clinton’s campaign; mentoring women entrepreneurs, or as a former member of Golden Seeds, an early-stage investment firm focused on women-led businesses, Deborah’s seen the lack of VCs who understand and want to fund female-run companies.

“Everything I’m doing now comes from those experiences of seeing amazingly talented women who just hit that glass ceiling or couldn’t break through. Women don’t have access to capital. They don’t get the support they need, which means women don’t create companies, or even when they do, they’re starved for cash.”

Plum Alley helps women entrepreneurs raise money without giving up ownership of their company. With crowdfunding, anyone—not just the wealthy—can use their capital to further companies and causes they believe in, and make good things happen in the world. Because crowdfunding platforms don’t provide investors with equity, an investor’s reward can take many shapes. It could be lunch with someone they’d like to meet, an experience, a thank you note, or if they help fund a documentary film, their name is in the credits.

“Women over 40 control the wealth in this country. We spend more than the 20 to 40 somethings put together, but most women don’t think about investing. They think about charity and philanthropy. Women need to step up. Women need to invest. It’s the best opportunity they have to make a return while furthering their values.

“A lot of women aren’t familiar with early-stage investing. They may understand traditional stocks and bonds, but with early-stage investing, there are huge opportunities there. Huge wealth creation.

“If a woman has a portfolio of stocks and bonds… Take care of that first, because you need that for the security of you and your family. But if you’re in a financial position to do something beyond that, other than philanthropy, think about impact investing: How do I make money but also do something I love? If you give women an opportunity to invest in things they know and care about, they’ll make the world a better place, and they can get an economic return.”